Automatic enrolment

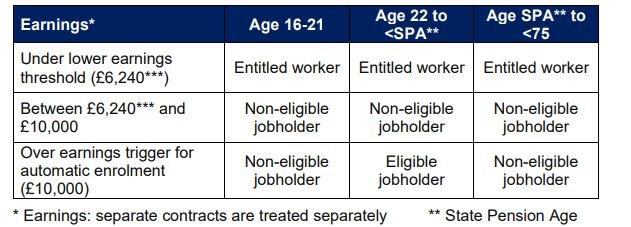

Automatic enrolment (or auto enrolment) was brought in by the Government. The idea is to help people save for retirement through a work place pension. Under this law, employers must automatically bring all ‘eligible workers’ into a pension scheme. They must also pay towards their employees’ pensions.

The LGPS is a qualifying scheme under auto enrolment rules.