The LGPS have released the 2025-2026 employee contribution bands for England and Wales, which will be effective from 1 April 2025.

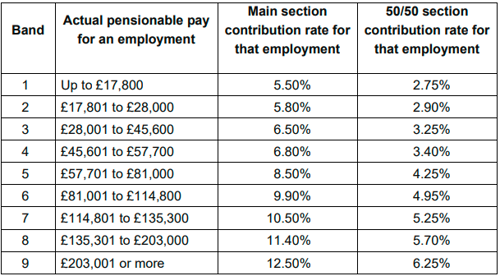

Both you and your employer pay contributions to pay for your LGPS pension. How much you pay depends on how much you earn. You will pay between 5.5% and 12.5% of your pensionable pay.

Every April your employer will decide your contribution rate. If you have more than one job, your employer will set your contribution rate separately for each job

The bands are calculated by increasing the 2024-2025 employee contribution bands by the September 2024 Consumer Prices Index (CPI) figure of 1.7 per cent and then rounding down the result to the nearest £100.

The latest contribution bands are displayed in the table below: